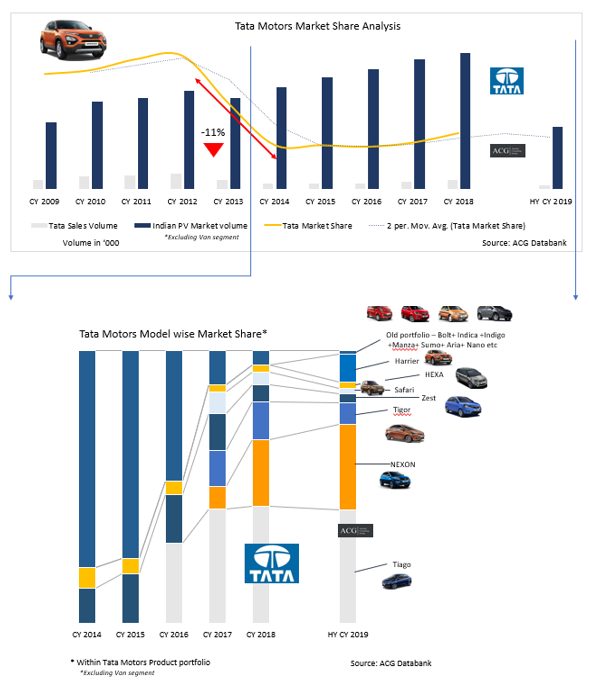

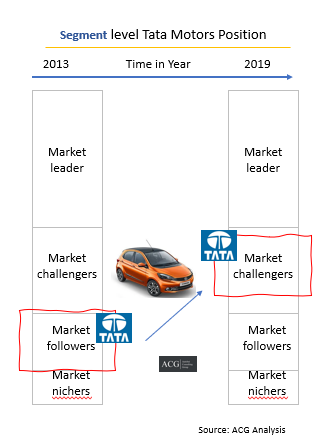

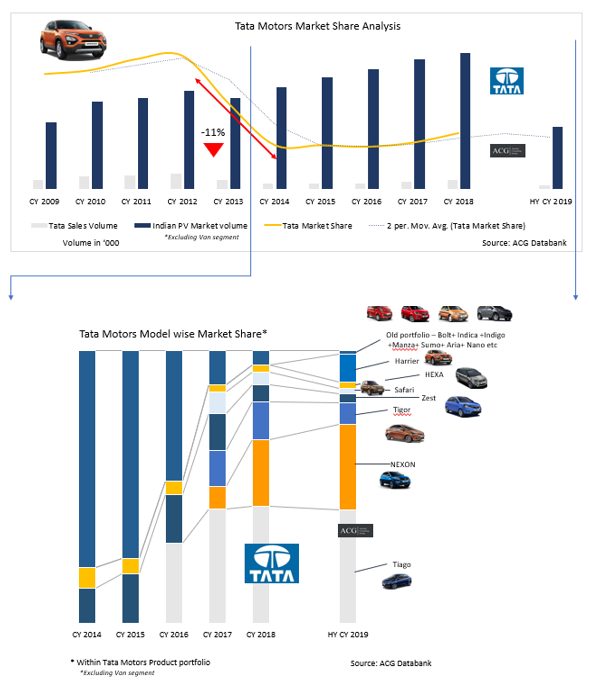

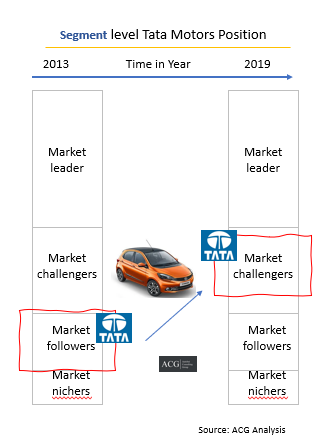

The Rise of Tata Motors Even After Losing Track is our detail report. The car market of India is necessarily become quite a competitive day by day. This can be clearly proved from the rise of Tata Motors even after it lost track between the years 2012 to 2014. In the year 2012, Tata Motors was in a commanding position in certain segments in the Indian car market with about 16 percent share of the market. In between the years 2012 to 2014, Tata Motors lost its grip in the segment of passenger vehicle and slipped down to about 5 percent market share from the commanding 16 percent. Some of the major reasons for the downfall so cited in this regard are poor product portfolio, changes in brand perception, and competitor position. These were some of the key reasons as to why the sales of Tata Motors went down in that period of time.

With the launch of Tiago from Tata Motors in the year 2016, the company started to regain its lost reputation once again which marked the rise of Tata Motors even after is lost track for quite some time. The pricing, product specifications, and outstanding features were integrated into the car so as to target Indian middle-class buyers who would be using the vehicle for personal use and not for a taxi. Before this, a lot of Tata cars were predominantly going to taxi segments. Now, in spite of that, the same is not happening as Tata Motors have simply outperformed the market since the year 2016.

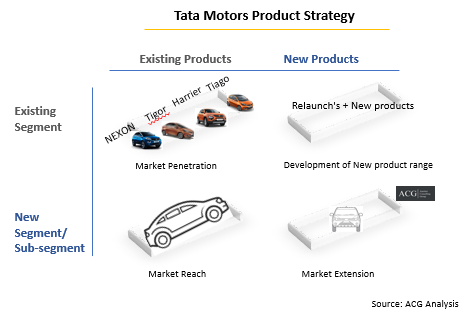

Most importantly, Tata Motors made a very smart move by promoting Tata Tiago and attracting the attention of the buyers by taking the football icon Lionel Messi. Tata Motors set an excellent example of how to change customer perception by changing its brand position by launching a new product range. Still, now, there is a very big opportunity for the company to increase the share of its market from seven to a whopping fifteen percent in the next three years of time.

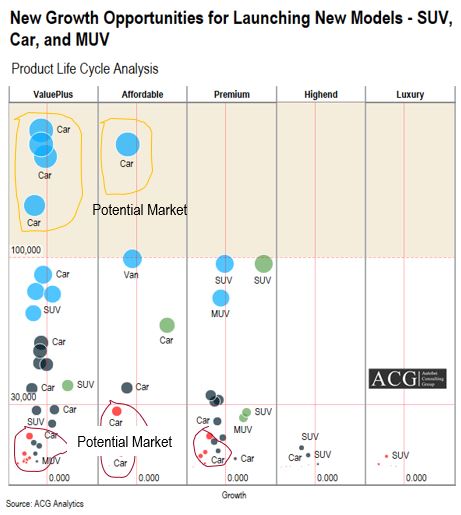

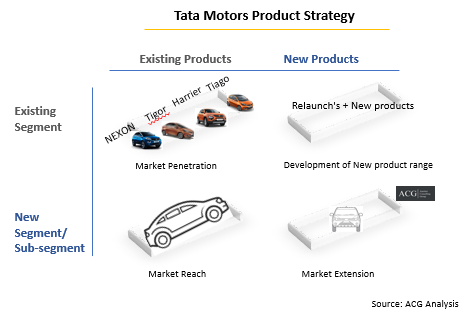

The product life cycle which is more popularly referred to as the PLC is the key behind the success of Tata Motors in the segment of the car as well as SUV. The top four models of the company are in the phase which is known as the ‘Growth in Product life cycle’.

The ‘Value Plus or Budget’ segment is the largest segment in the overall Indian car segment as per the ACG definition. The segment share of Tata Motors in ‘Value Plus’ segment is about 81 percent in CY 2018 within the Tata PV segment. Tata Motors as a company is still not present in a number of segments as well as sub-segments.

ACG made an analysis of the success factor behind each and every model necessarily had its own USP. For example, the Harrier design is the first feature of the vehicle to take a call to find out more about the vehicle.

Harrier is in the premier SUV segment for the buyer who wants to upgrade their SUVs or cars. Brand loyalty and customer advocacy also play quite a vital role in the enhancement of its sales and performance. This is certainly going to be game-changer for the company. The company, Tata Motors has quite successfully changed its product image which is undoubtedly a great improvement from the perspective of the brand.

Most importantly, the dealers are also cracking deal with the aggressive strategy thereby enhancing the brand image of Tata Motors once again after it had lost track between the years 2012 to 2014. So, we have to just wait and watch what Tata Motors exactly does in the time to come.

Key Highlights of the Report:

- Indian Car (PV) market size and Forecast

- Tata Motors Sales and Market Share assessment study

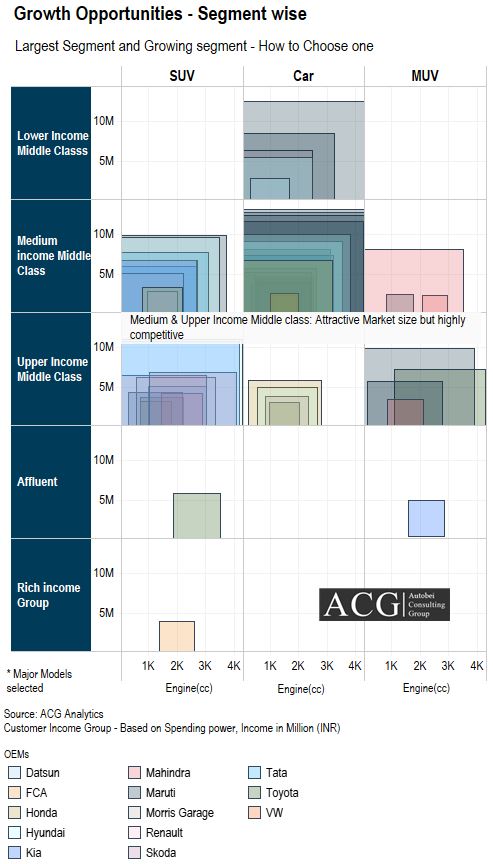

- Segment and Sub Segment Analysis

- Tata Motors Product Portfolio and competitor Analysis

- Car, SUV, and MUV product strategy

- Product Price, Discount, Exchange schemes, Features, and Specs

- Customer segment Analysis

- Dealer performance

- Challenges and Opportunities

- GAP Analysis

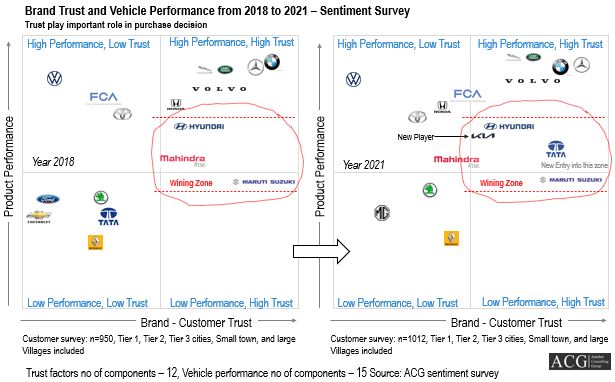

- Brand Image, Position, and Perception

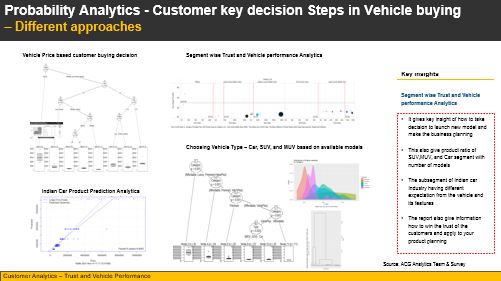

- Buying Journey of Tata Motors existing and Potential consumers

- Marketing Strategy of Tata Motors

- Advertising Analysis and its impact

- How the company created value for its customers