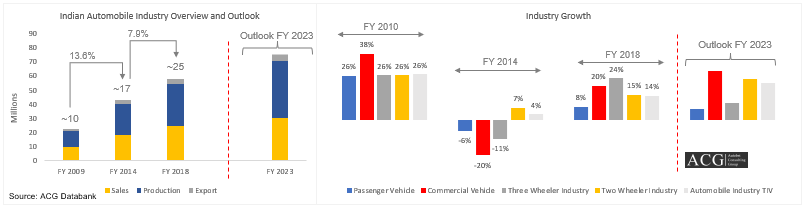

Winning the Indian Car Market battle report gives key insight of OEMs Strategy and Customer buying journey. The automobile industry is an always booming market which keeps on improving and developing with time. The Indian car industry is has developed with new and sophisticated technology which has attracted new customers. All the car brands are improvising their standards and technology which has increased the brand value in the market.

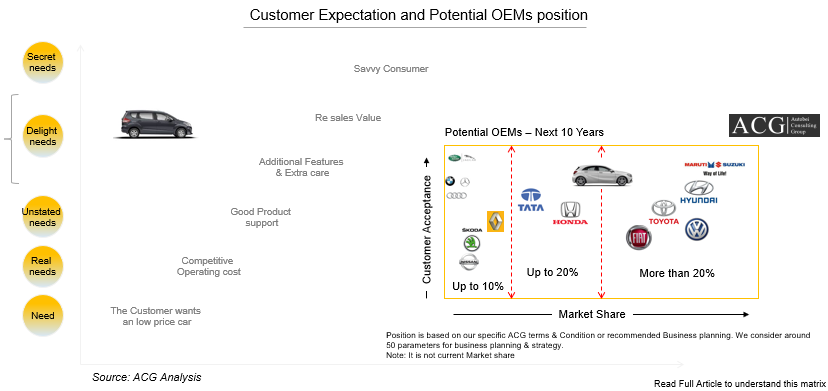

The Indian car market is mainly dominated by the always trusted Maruti Suzuki from a long period of time. The leading global automobile OEMs like the Volkswagen, Toyota, Honda, Tata Motors, Fiat, Mahindra, Nissan, Renault, and Skoda are not able to reach the level of brand value or the sale rate in the current market of Maruti Suzuki market share. There is considered to be more than a 30 percent market share gap between the current market leader and upcoming market challenger position. The market share gap is created due to the influence of the market dynamics and customer choice for their low volume.

The world’s largest carmakers Volkswagen, Toyota, have a minimum share of 1.4 percent and 4.3 percent in the market share in the current Indian market respectively in the year 2018. The global automobile giants have developed and are trying to improvise their technology standards, brand-name in the market, product portfolio, best talent, industry Experience, robust infrastructure and the advanced research and development facilities, best cost-effective solutions and advanced manufacturing technology. The global automobile giants were not able to make any kind of impact on the brand value and sale rate in the current Indian market. The international automobile brands tried their level best to increase the volumes or market share in the current automotive market. These brands have developed an infinite possible method to increase the volumes of the sale in India but with a lot of loopholes.

India is one of the major car market in the world and strategically it is important for the OEMs companies to have an iron grip on the current Indian automotive segment. It will be an interesting idea to find out the reason why the globally giant OEM companies are not successful in the current Indian market and even the big companies like the GM and MAN have decided to quit the Indian market due to their unsuccessful stint in the market. To be successful in the market the companies must make sure that all the key elements are addressed properly like brand management, product viability, customer satisfaction, product support, product acceptability, and affordability are few of the parameters. The missing or ignoring factors are enough to take the brand out of the market. In this report, we have listed the OEM wise analysis which has been made based on their performance against each category along with a solution.

We have analyzed other problems and the factors that make the Indian OEMs not successful in the overseas markets. The major companies like Tata, Mahindra, Maruti Suzuki, Ashok Leyland’s have the largest and key market share in India only. If an Indian company can succeed in the foreign market, it could have made a big impact not only on these OEMs companies but even on the economic structure of the country. Our reports and solutions will show the path to Indian OEMs on how to get an impressive market share outside India.

The most common justification made by the global OEM companies is that the methods used by the trusted and branded companies like the Maruti having a wide range of dealers and a better sales network. The other foreign OEM companies are not able to build a network like Maruti, hence the competitor’s companies will not be able to become a leader in the market. This is one of the major reasons behind the success of Maruti. There are other major reasons for the rich product portfolio and operating economy of Maruti like service satisfaction to the customer and meeting the customer need and requirements. The competitors have innovated new methods so that they can compete in the market and procure at least 30 percent of the market share value.

The major reasons for the incorrect market research, methodology or the market intelligence information or other sale rate alerting problem is due to the wrong data interpretation of market trends. If companies do their business review internally, there will be many important key points which will be ignored due to negligence and these factors will impact the company’s market value. ACG have done micro-level research and analysis of each the Car OEMs and their complete business strategy. ACG is probably the only business consulting company which will give maximum probability to become successful in the market if the company follow our business strategy. A successful business strategy is a set for all key activities in a scientific way which will help improve their market value.

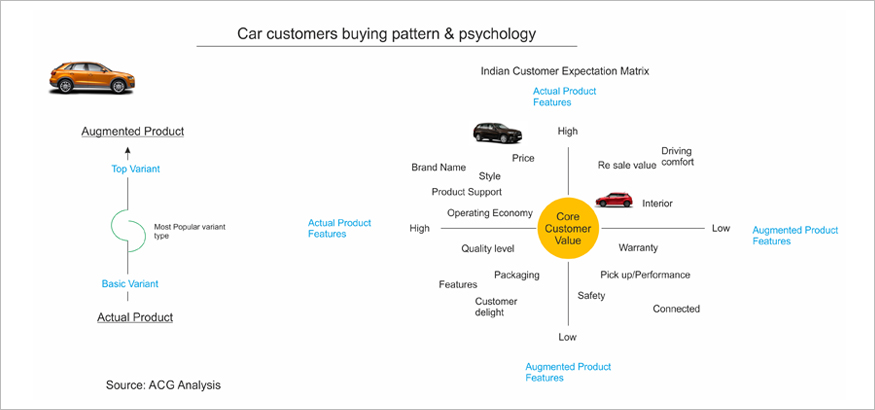

The price of the products and the product feature elements are almost the same in the same segment car or it can be copied. The other major factors that have to be considered by other struggling OEMs in the market are the customer delight, product position in the market, brand perception among consumer, customer buying map, customer connect, review of the product and brand strategy. These factors will be improved frequently and changed if there is a need to be changed.

The major companies like Volkswagen have invested a lot of money in advertising only and it is assumed that the advertisement could help sell the products and create the brand value improvement. Avoiding the advertisement strategy is the problem with most of the companies due to which they are currently facing low sale rate in the market to raise their brand value.

The continuous running ads and advertisements using social media platform are one of the improved features for doing an effective campaign with the right message and targeting potential customer in the market.

The medium and method of how Maruti has become the market leader when compared to the other OEMs will be discussed in this segment. There have been several examples that will pave the right path to develop a strategy that can change the market leadership position in the trending market. We have identified many small but effective strategies and different effective activities which will have a big impact on brand built trust and make brand memorable among the consumers. There are many innovative methodologies that can be implemented to increase the market share but the OEM companies did not touch or think about those innovative ideas which still makes Maruti Suzuki leader in the market.

ACG has done an in-depth study from the past three years and they have found the important points the other OEM companies have missed. We have identified some common mistakes which have been done by most of the companies:

- Entering the largest segment of the market without considering the important parameters of the segment that can improve the sale rate of the product.

- Due to the wrong forecast was done by the internal/external team.

- Selecting the potential of a chosen segment to enter the market which does not suit the product.

- Not collecting the data or lesson learned from previous unsuccessful OEMs who failed in the market.

- Make sure that an advertisement is not a brand strategy that is to be adopted to improve brand value.

- Incorrect mapping to know the need of the customer regarding the products.

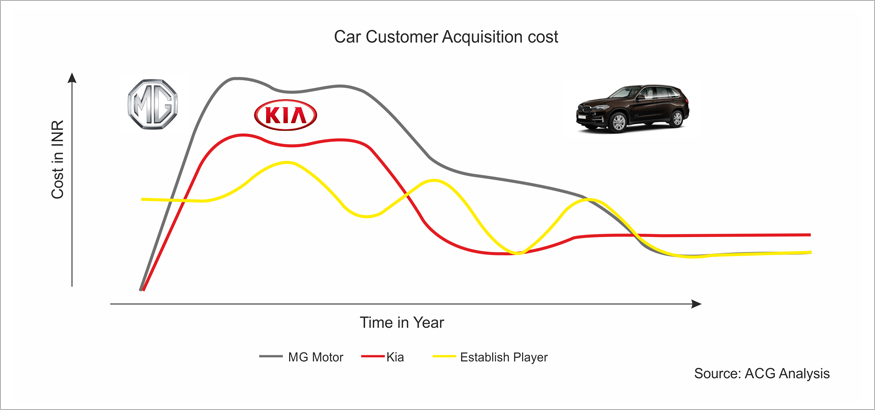

- To strategize methods to improve the customer delight which can save a lot of company money to save customers acquisition cost.

- Ineffective methods to improve brand and product improvement strategy.

- Miss interpretation of data to device plans to improve brand value.

- An ineffective integrated marketing communication strategy that can improve brand value.

- Do not check the ROI on some periodic basis.

- Making strategy regarding the improvement of brand value without critical analysis of the market trends.

- Create value for the brand among the consumers of the product.

- How effectively marketing implementation is working

- Not doing proper study and analysis regarding the appropriate marketing information and customer insights on the product.

- Provide employee training to have better insight regarding the product.

- Marketing Budget Allocation Strategy

- Improve HR policy for better talent acquisition.

- Improve network strategy that can improve brand value.

- Do the brand audit and their process that can improve brand value.

- Improve the product portfolio and pricing strategy of the product.

MG Motor entered into Indian passenger vehicle segment with high expectations. The company is planning to launch its first SUV product in the Indian market. This product will prove to be a value and a competitor for other products. MG Motor is entering into the new market by serving in a single segment and if the new product proves successful in the market, in that case, it is expected that they will add more vehicles in the market a concurrently improving their brand value among other competitors. It will be attractive to know what the company plans to promise their customers that the company is going to do for their benefit and to attract more clients in their bag. MG Motor India is a wholly-owned subsidiary of SAIC Motor Corp, China. The brand origin is Chinese but the company’s brand strategy portrait like it is a UK based company. The other Chinese company like Foton and CNHTC could not make their presence effective in India even with improvised strategies.

Another new brand like Kia Motor is also knocking door to enter the Indian market. In the case of Kia, the customer acquisition cost will be less and market knowledge will be provided by Hyundai. This pact can be beneficial for them provided they provide the need and meet the requirements of the Indian customers. Kia found success in the US market by introducing high-quality inexpensive product proposition with attractive after-sales support.

To create value for customers and build meaningful relationships with them, Companies like Kia or MG Motor must first gain fresh, deep insights into what customers need and want. Such customer insights come from good marketing information. Companies will have to use these customer insights to develop a competitive stage to build and sell products as per customer needs. There should be a campaign which will emphasize the need to have a strong emotional connection between Indian consumers and their brands.

New brands always try to capture the market with their products, but to sustain and to maintain their brand value like Maruti Suzuki in the current market trends it requires a deep connection between the brand and the customer. Until the brands are not able to connect with people it will be difficult to keep a hold in the market. Brands should strategize new and refreshing ideas to connect with people and improve their brand value. The current Indian market is ruthless in the selection of products. Brands will have to be smart as well technologically developed to connect with people. The more you connect with the people more the brand value will increase.

How ACG can Help? ACG provides end to end detail Business planning and Strategy Consulting service which cover almost all business vertical. We do a macro-level analysis and create a winning market strategy. Our special strategy experience brings key insight to win the Indian car market battle.