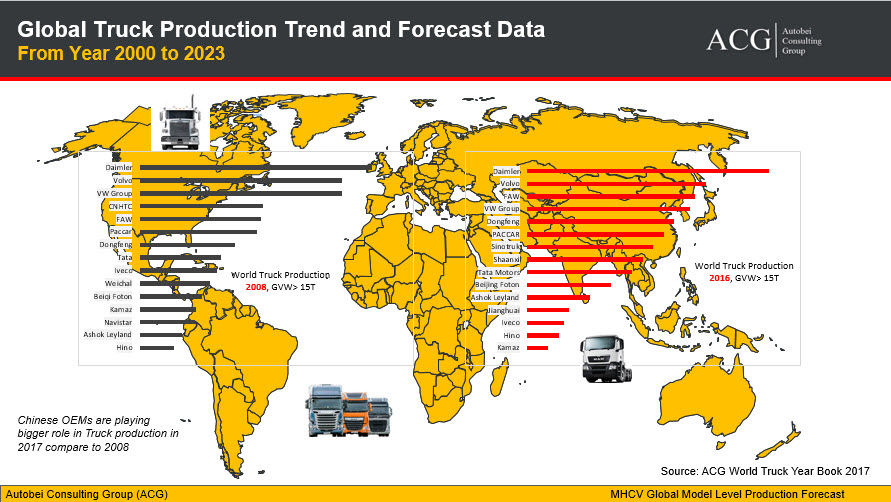

ACG released latest data on China Brand and Model wise Commercial Vehicle Production Analysis. It covers exclusive critical market intelligence detail of Vehicle and Engine of Commerical Vehicle of the Chinese market. There are 77 OEMs are included with all their brand level production trend since 2001 to next 5 years Forecast. The database is helpful for existing OEMs, the new entrance and planning to enter into Chinese CV Industry. It could be the decision maker to create Business Planning, Production Planning, and Investment Strategy.

Few of OEMs which are included in the database listed here:

- CNHTC

- FAW

- SAIC Motor

- Beiqi Foton

- Shaanxi

- Dongfeng

- JAC

- Isuzu

- Toyota

- Volvo

- Zoomlion

- Beijing North Neoplan

- Yangzhou Yaxing

- Fujian

- China National Bus

- Wangpai

- Xugong

- Yaxing

- Yuejin

- YUKANG GROUP

- Yutong

- Zhongda

- Zhongtong

- Zoomlion

- China Motor

- Xian Silver Bus Company

- Chongqing Heavy Vehicle

- Shanghai Sunwin

- Feidie Automobile

- SHANGDONG TANGJUN OULING

- Shanxi

- Dandong Huanghai

- Nanjun Vehicle

- Sichuan Station Wagon

- SUNLONG BUS

- Suzhou Kinglong

- Guilin Daewoo

- Sichuan Toyota

- Shenyang Shenfei Hino

- Guangqui Hino Motors

- Zhengzhou Yutong Coach

- Xian Silver Bus Company

- and others

Database Highlights: Short-term China Truck & Bus demand outlook & Long-term China Truck & Bus demand outlook

- Structure of Truck and Bus Industry

- Truck and Bus Product Architecture

- Fuel Type Product Analysis

- Vehicle Platform detail

- Vehicle Program information

- Segment Information- region wise

- Vehicle Design Patent

- Vehicle Emission standard detail

- Start of Pand End of Production

- Production plant location and Capacity with Model name mapping

- Truck and Bus Assembly

- Engine SOP and EOP of each model & Brand

- Valve & Cylinder Information

- GVW Model level

- Parent sales Information

- Cylinder Block Material information

- Vehicle Engine Displacement Detail

- Brand-wise Model Name – Production Nameplate

- Engine Power & Torque

Other details like Macro Economy, Govt policies, regulation, OEM Strategy Analysis, Intercultural Analysis, Negotiation style Paper, Product Analysis, Product Life Cycle, Product risk, Market Drivers, Market Dynamics, Chinese Transport Industry are also available on request