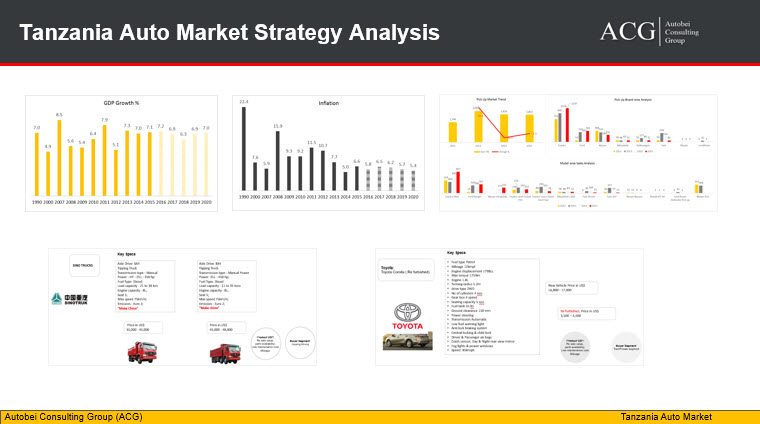

Tanzania Auto Industry Auto Industry Analysis and Outlook is a detail report. It is part of East Africa Auto Industry Analysis. Tanzania maintained steady, high growth over the last period around 6%–7% per annum. The inflation rate is under control of around 5 percent and poverty rate declined.

Tanzania’s economy with its ever-growing middle class is powering a growing and impactful Regional Auto industry. New products, OEM strategy, Assembly units and an old manufacturer returning, are reshaping Tanzania’s Auto Industry. An East African market is having huge potential for Auto Industry. Tanzania is one of the key markets in East Africa region.

In 2016 the Passenger vehicle segment showed 19 percent degrowth and even the Truck segment showed de-growth. However, the bus segment registered some positive growth.

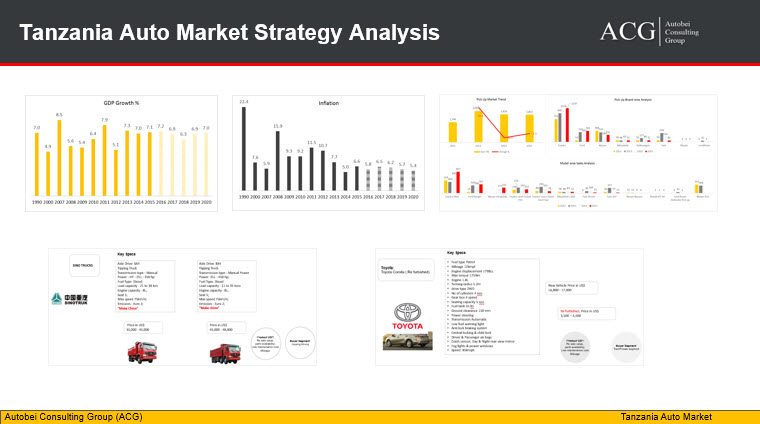

The market is divided into New, Refurbished and Used vehicle. To increase the market share of new vehicle sales, OEMs are looking into options to assemble vehicle parts locally or import from Assembly in Kenya and another neighboring country. This step also avoids the import duty on a new vehicle.

Pick up segment is the largest segment in Tanzania with more than 60 percent market share, followed by SUV with more than 30 percent. Car and Van make up 2 and 1 percent respectively of Tanzania’s Auto Industry.

Hatchback, Saloon and Station wagons are major body type vehicles in Tanzania. B and C type vehicles are more popular segment since it is price sensitive market.

In SUV segment, Toyota, Land Rover, and Nissan are major players. In SUV segment, C and D body types are dominating vehicles. Van’s market is stagnant and Maruti is the market leader.

The price of the one of the refurbished SUV model is around 12,000 US$ and brand-new vehicle price is 24,000 US$. We have covered prices of all key models of all segment in our detail report.

The Chinese OEMs are also trying to crack SUV segment fast, to have a significant presence in East Africa.

In Pickup segment, Toyota, Ford, and Nissan are major players. Toyota Hilux is the market leader in this segment.

The standard warranty on these vehicles is 3 years or 100,000 Kms whichever occurs first.

Investment in Infrastructure development and steady growth in agriculture and transportation are the main key drivers of the Cargo Vehicle segment. Road transport is the major transport segment because rail network is inefficient. For all major goods, transportation Cargo vehicle (CV) is mainly used.

Heavy Duty Truck is the largest segment in Commercial Vehicle segment. Chinese OEMs are dominating the market due to its price positioning and cordial ties in Afro-Chinese Political & Economic relationships. There is a quantum difference between the market prices of Chinese and any another foreign brand.

Chinese automobile brands improved their brand positioning in the last couple of years. Sino Truk, Foton, and Dongfeng are few major Chinese brands in this segment. Most of the Chinese brands offer customized vehicles which suit the market dynamics of the country of Tanzania. For example, they install heavy engines and bigger fuel tanks which suit long distance movement of vehicles. Their new Chinese vehicle price is almost half compared to the new vehicle price.

Volvo and Scania are popular brands in the refurbished Truck segment. Scania buses are also popular in luxury bus segment.

Tata is the market leader in Medium Duty Truck segment while Mitsubishi is the market leader in Light Duty Truck segment.

Eicher, Kinglong, and Tata are major players in Bus Segment.

The important buying criteria for Truck purchase are the mileage it offers, Low maintenance cost, and its resale value.

For marketing and brand awareness the most effective promotional media are Bill Board ads, Auto magazine, and Trade Fairs.

Report Highlights:

-

Industry Overview

-

Commercial Vehicle and Passenger Vehicle Sales Trend and Forecast

-

Market Drivers

-

Market Challenges and recent development

-

Model Level Analysis of Passenger, Truck and Bus segment

-

Product Analysis – Price, USP, buyer segment, Technical Specs and Position

-

Brand position and perception

-

Detail Sub-segment Analysis