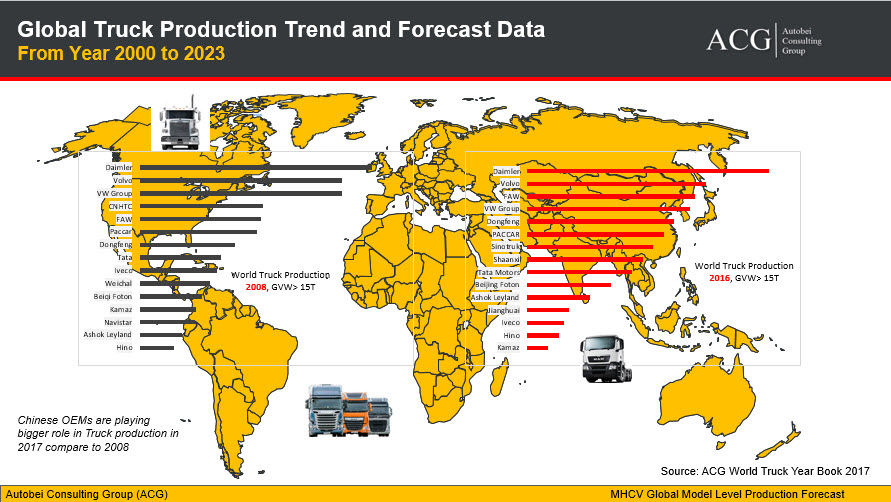

ACG Auto Intelligence released World Truck Production forecast with historical data since 2000. Europe, Greater China, Japan, Korea, Middle East, Africa, North America, South America and South Asia region are covered on country wise.

Countries included: Austria, Belarus, Belgium, India, Czech Republic, Estonia, Finland, France, Germany, Hungary, Ireland, Italy, Kazakhstan, Lithuania, Netherlands, Poland, Portugal, Romania , Russia, Slovakia, Spain, Sweden, Turkey, Ukraine, United Kingdom, Uzbekistan, China, Taiwan, Japan, South Korea, Iran, South Africa, Canada, Mexico, United States, Argentina, Brazil, Colombia, Ecuador, Peru, Venezuela, Australia, India, Indonesia, Malaysia, Pakistan, Philippines and Thailand.

In our forecast, we considered all critical factors which could impact on Market.

The forecast is included OEMs past production data with their past trend.Under OEMs we have also exclusively included their model production numbers, production plant detail and other key information like:

- Sales distribution –countrywise from mother/source plant

- Vehicle details – Models, GVW, Segment, Gross vehicle weight, Engine max torque, Gearbox, Engine Displacement

- Vehicle Architect

- Vehicle design

- Vehicle Platform

- Emission norms

- Start and End of Production

- Production brand name

- Parent brand name

- and other 30 more product and market attributes

ACG Subscriber can download this report by login their account