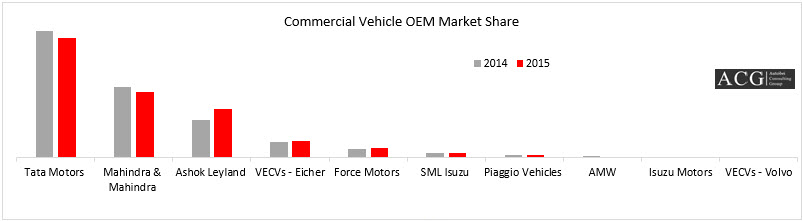

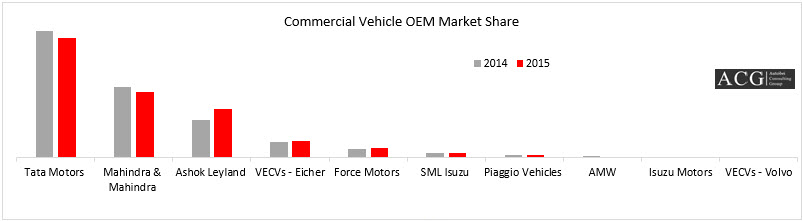

The Commercial Vehicle Industry sales over the past year has been analysed and presented in this report. The overall sales have definitely seen growth from 2014 to 2015. 2015 has seen a 7% increase in sales of the commercial vehicle industry. Some companies have seen a stunning growth in sales whereas others have borne witness to a dilapidate fall in the same year. Overall however, this industry has managed to see a pleasant sales figure. The following figure shows the statistics for the brand wise market share and sales of commercial vehicles and their growth over the period from 2014 to 2015.

Though Tata motors stands first in the race for market share, it has seen just a slight increase in sales corresponding to 1%. Their market share however favourable has dropped by 3% owing to the growth of several other companies in the same industry. Mahindra and Mahindra who were the runners up to Tata Motors have seen a reduction by 1 % in their sales. What may be most notable about these figures is the scenario of Ashok Leyland which has showed a stunning 40% growth in sales. Companies like Isuzu motors, Volvo, Eicher and Force motors are also characterized by increase in sales over the same year. Piaggio however has seen a staggering decrease in sales losing their already low market share to a mere 0.77%.

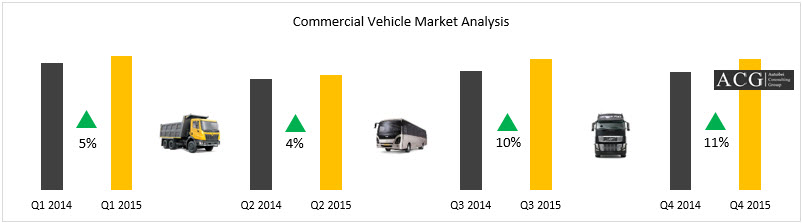

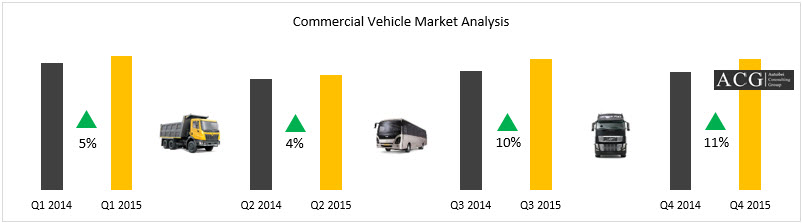

Quarter wise Sales Analysis:

The Quarter wise analysis was able to point out to the following conclusions. The various quarters of the corresponding years 2014 and 2015 were analysed and this is what we found. Quarter one showed a slight 5% increase, while quarter 2 showed the minimum increase by 4% in sales. Quarters 3 and 4 however showed a huge increase sales corresponding to 10% and 11% respectively. Overall, the sales figures look good for this segment.

The company AMW was studied. The report first entails its change in sales which plots the percentage change in each quarter. The figures dont look too good for the company as the percentage change just seems to be going downhill from an already astoundingly low 35% in the first quarter. The percentage change in quarter 4 from 2014 to 2015 shows an excruciating drop to 79% decline in sales.

Linear to the sales figures, the market share for AMW motors shows a similar trend. Compared to the corresponding quarters in 2014, the 2015 quarters have shown a significant dilapidation owing to various factors. What can be said though is that this is a cumulative effect combining the effects of the first three quarters to drop to an all time low in the fourth quarter figures.

This company is in stark contrast to AMW and has seen a positive growth in sales from quarter 1 onwards. The highest ascent however was seen in the case of quarter 4 with more than 4% increase in market share. Overall this company has seen a positive growth.

The monthly sales figures of AMW motors for the year 2015 has been discussed in this report. The scenario in the case of AMW has not been a pretty one with sales dropping to a negative 0.08% gradually with the months. There was a slight increase in sales in the month of October, but it has been a dry year with sales only dwindling and not increasing by much during this year.

When the change in quarter is plotted, we can see that quarter 3 has seen some good figures of Ashok Leyland, however the other quarters have seen an increase, but not as much as the third quarter comparing the period from 2014 to 2015. This quarter wise analysis gives us better insight as to what goes into increasing the share and where it happened. Quarter 3 has seen as exorbitant 55% increase in sales over the year.

Ashok Leyland is one of the pioneers of the commercial vehicle industry and being one of the front runners of this segment, sales have indeed skyrocketed. The months of March and September have been exceptionally fruitful with a considerable increase in number of vehicles sold. The months following April untill August have seen stable sales with constant figures not increasing by much, however the year ended with a firework with more than 42% increase in sales by the end of December marking the beginning of a wonderful next year.

Force Motors first quarter analysis shows that it was a significant quarter which showed a good 17% increase in sales. Quarter 2 has seen a plummeting decrease in sales by 2%. However, this was a short-lived misfortune when the company rose to a 14% increase sales in the third quarter which rose to 16% in the successive quarter.

The market share of Force Motors in the current segment has revolved in and around 3%. All four quarters saw a slight increase in market share during the course of the past year, when analysed quarter wise.

Force motors saw it's prime time in April of 2015 where sales skyrockets and crossed the 3,000 units bar, far more than the sales figure of any other month last year. However, this celebration was short lived as it suffered yet another major loss of equivalent magnitude as it dwindled it's sales into the month of May. They were able to recover from the dwindling sales in the coming months and manage constant sales figures, but it never came to as high as in the month of April.

When the quarter wise percentage change is plotted against sales, we get an upward rising curve. This indicates that sales is rising with every quarter, the maximum being in the 4th quarter which saw almost a 17% increase in sales from the mere 14% descent in quarter 1 .

As the market share is assessed with every quarter change, a similar situation arises. Quarters 1,2 and 3 have seen around 2% increase in market share. The fourth quarter reveals that a market share as high as 27% is reached. However, the first quarter saw a major decrease of more than 5% from 2014 to 2015.

The market share of Piaggio mapped against each quarter from last year 2014 to 2015 is analysed in this report. This report shows that each quarter saw a decrease in market share from what it was in 2014 when compared with 2015. This change was especially significant in the fourth quarter when Piaggio almost 50% of its already low market share.

The sales curve shows a similar trend in comparison with each quarter. It began with Piaggio losing 9% of its sales in the first quarter over the course of one year from 2014 to 2015. Slowly however, it concluded with the fourth quarter showing a 25 % decrease in sales over the same period.

The first quarter saw a significant increase in sales of more than 50%. However, quarter 2's growth was mostly stable and it is characterized by what appears to be quite a flat curve. Quarter 3 saw a slight increase in market share. However, quarter 4 saw a slight decrease in market share. However, when we compare the market share for Quarter 1 in 2014 and 2015's quarter 4 market share it can be seen that not much has changed market share wise over the duration of one year.

The quarter wise analysis of the sales figures of SML Isuzu over the year has showed a chair shaped graph. Sales were at an all-time high in quarter 1. However, quarters 2,3 and 4 rang in synchronism with the market share graph and showed areas of either reduction or stable changes in sales.

Isuzu doesn’t have that big a market shares to boast about, but it definitely has increased with the passing quarter. Quarter 1 has seen more than 100% increase in market share over the duration of one year. So has Quarters 2 and 3. Quarter 4 has also seen a slight increase in market share. As far as quarter 4 is concerned, market share stands at a 0.18%.

The quarter wise sales graphs show an exasperated increase in quarter 1 sales figures over the year. Quarter 2 and 3 have also shown a significant increase in sales, though smaller than that of quarter 1. Quarter 4 on the other hand sees a minor increase of 46% in sales over the year.

The report encompasses the variation of sales of Tata motor vehicles with the passing of every quarter over the year from 2014 to 2015. A close look at the graph will yield a 5% increase in sales during the quarter 1 phase between 2014 and 2015. Quarters 2, 3 and 4 on the hand have shown either a very minor or almost no change in sales at all.

The Market share graphs are also not very appetizing. Though Tata motors owns this segment with almost 50% share of the market, this brand is slowly losing that value due to various reasons. Quarter 1 saw a very slight decrease in market share. Following that, the company has seen some major reductions in market share over the other quarters.

The graph of Sales versus quarter percentage change of this company over last year has been an increasing graph, boasting a 12% increase in quarter 1, slowly climbing to a 14% in both quarter 2 and 3 and steeping to an astounding 36% increase in sales of quarter 4.

Corresponding to the increase in sales, the market share of VECV Eicher has also increased to new heights in the fourth quarter over the past year. Quarters 1, 2 and 3 have also shown significant increase in market share over the year visible with the sales figures that were analysed previously.

Volvo has also seen increases in it's market share. However, it's market share is not as high as that of Eicher. Very similar percentages of increases in market share is seen over the quarters over the course of one year from 2014 to 2015. It's overall market share has however increased from a mere 0.10% in the first quarter of 2014 to more than 20% in the last quarter of 2015.

The sales curve also tells a similar story. The first quarter has shown a refreshing 54% increase in sales over the year, which has steeped to 40% in the second quarter and further plummeted to 28% in the successive quarter. It has managed to climb up to 34% in the last quarter.