Every year there is a tremendous development in the bus sector with modernization and with the innovation of new techniques and features. The innovation of highly developed bus vehicles led to its introduction into different sectors.

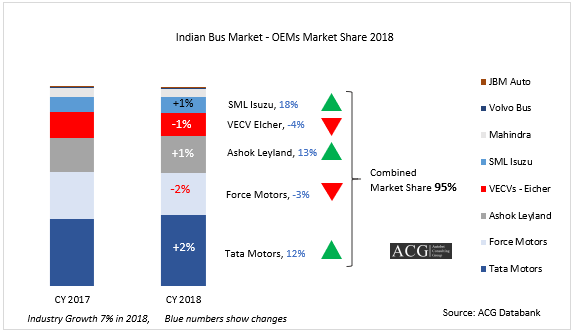

In the year 2018, the bus industry witnessed a record growth rate of 7 percent when compared to the growth rate in the year 2017. Tata Motors increased 2 percent market share whereas Ashok Leyland market share increased by 1 percent, Luxury Bus manufacturers like Volvo have had a stagnant market share rate of 0.4 percent with a minor increase in volume.

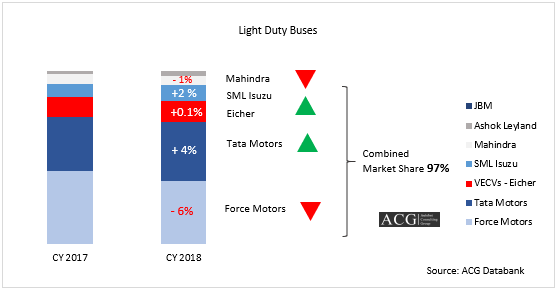

A market leader like the Force Motors was on the decline losing 6 percent of the market share in the Light Duty bus segment. The performance of Tata Motors improved in almost every segment. Its market share increased to 4 percent whereas in the case of Ashok Leyland the leading market holders of the bus Industry improved their market brand value and gained a 1 percent market share. The bus segment grew by 13 percent in the year 2018.

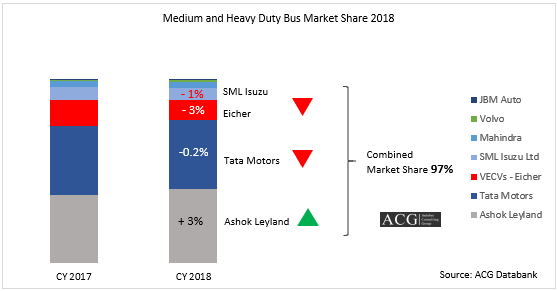

The Medium and Heavy-Duty Bus segment is stagnant due to the decreased demand for Medium and Heavy-Duty Busses. In the Medium and Heavy-Duty Bus sector, Ashok Leyland gained 3 percent market share whereas Tata Motors market share remained stagnant, VECV and SML Isuzu also had a decline in the market share rate in the year 2018.

The introduction of new norms marked the enforcement of the bus body code (AIS 052), and the school bus code (AIS 063). The initiation of bus codes provided a base for good growth in the bus sector, the industry also witnessed the initiation of the sleeper bus code (AIS 119), which is claimed to be a world first. The Progress in the sector was also achieved in tarmac and double-decker bus code draft. The initiatives from government run State Transport Undertakings (STUs) and City Bus Undertakings (CBUs) as well as private bus fleet operators to provide high rate orders improved the growth rate of the segment. Factors like the bus code, demonetization and GST impacted STU orders in the year 2018. After Bus code relaxation and GST is stabilizing the market is expected to improve hence the demand is expected to rise again.

The bus industry is one of the most important and highly developed segments of the Indian automobile industry. It is the most commonly used and widespread public transport in India as well as in other countries. The industry comprises of buses that are categorized into school buses, mini buses, tourist buses, deluxe buses, commuter buses and others depending on the purpose of the use of the vehicle. Owing to the development in the infrastructure and roads, connecting to remote places has become easier due to which more and more people are availing bus services in a day to day basis. This has greatly contributed to the growth of the bus industry. The growth in this market has stimulated the manufacturers towards more innovations and development in the technology used in the bus. New buses have been introduced that are well equipped with advanced facilities and services such as passenger information system, air-conditioners, high-quality engines, air suspension, and transmission systems and much other safety as well entertainment features. With the increase in the use of such buses over the next few years, the customer base is also expected to ascend at a high rate.

With respect to increase in the commuter base, even foreign companies such as Daimler, Mercedes, and Volvo are making heavy investments in this segment of the automobile industry in India. New standards of luxury and comfort have been set by these companies in the tourist bus segment by providing high class and advanced air-conditioned buses.

There is an invention in every segment on a day to day basis; the bus sector is also expected to grow at an alarming rate with the increased rate of consumers. As the rate of growth increases the company will have to develop new methods and plans to keep the consumers at their bay. This, in turn, will also improve the economic and financial status of the country. We can always hope for success in the segment in the coming years.

Report Highlights:

- Bus Market Overview Trend and Forecast 2024 – Volume and Value

- CAGR Analysis

- Bus Seating wise Volume

- OEM Application wise Market share

- Qualitative Analysis of the Industry

- Key Drivers of the Industry

- SWOT Analysis

- Application wise Competitor Analysis

- Top Selling Models and their Specs

- Price and Discount analysis

- Margin Analysis

- Product Support and Customer expectation

- Product Analysis – Portfolio, Mapping with Customers and Application, the Life cycle of the vehicle, Product Position, Model wise Best and Worst features

- Brand Analysis and Perception

- Route Analysis

- Premium Bus segment Analysis

- How OEMs planning to introduce or upgrade the vehicle

- Electric Bus Market Forecast

- Bus TCO analysis

Please send your requirement for a customized study to info@autobei.com