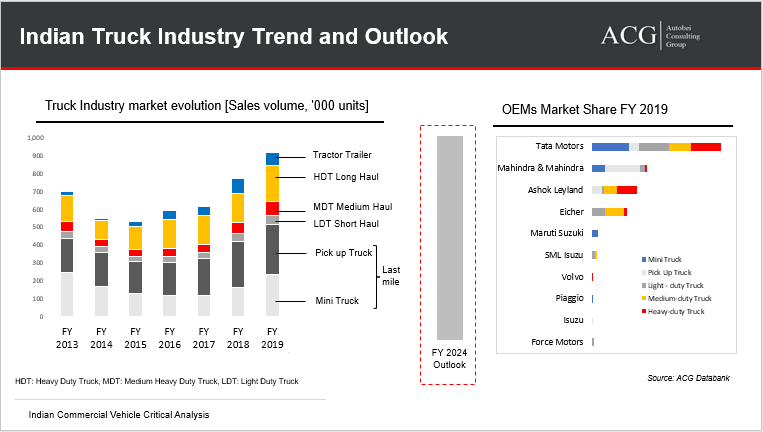

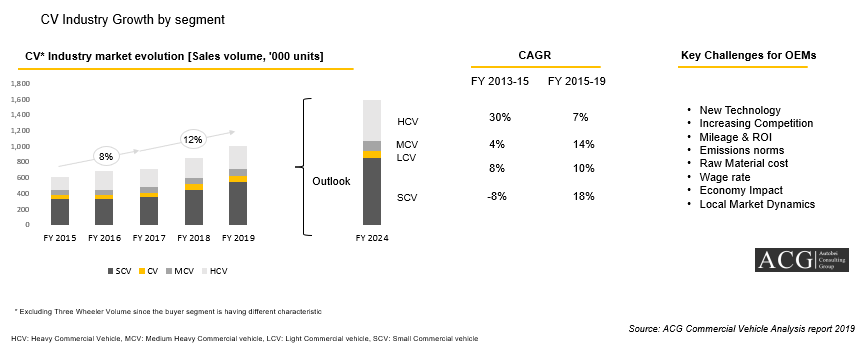

The future trend of the Indian Commercial Vehicle market is the most detailed report. The current Indian Commercial Vehicle market size is over 1 million units and in terms of value, it is USD 14 billion in FY 2019. Tata and Ashok Leyland are the current market leaders in the commercial vehicle segment.

The commercial vehicle segment has registered an 8 percent CAGR between the years of 2012 and the year 2015. The commercial vehicle segment was able to register a growth rate of 8 to 12 per cent between the years 2012 to 2015.

Between the years 2013 to 2015, the CAGR for the SCV segment was -8 per cent. In the following years, the CAGR jumped to 18 per cent between the years 2015 to 2019. In the HCV segment, the CAGR came down to 7 per cent from 30 per cent between the years 2015 to 2019.

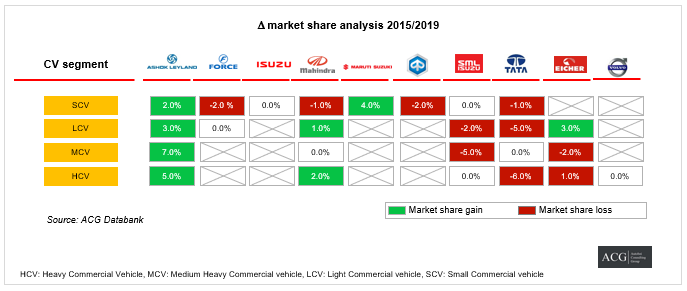

In the SCV segment, Ashok Leyland and Maruti Suzuki gained a better market share. The major players like Tata Motors, Mahindra, Force, and Piaggio lost their market share for the year 2019 when compared to the year 2015.

In the LCV segment, Ashok Leyland, Mahindra, and Eicher gained a better market share. In the MCV segment, Ashok Leyland is the only OEM that gained a 7 per cent market share due to its product portfolio and service options. In the HCV segment, Ashok Leyland and Mahindra increased their market share by 5 and 2 per cent respectively in the year 2019.

The industry has started to face new challenges and hurdles with the innovation of new technology, emission norms, market sentiments between the customers, Cost pressure on the customers, expected rise in oil prices, and tight financing. Infrastructure development and border-free movements are positive changes in the industry.

Indian Truck Industry Trend and Forecast:

Indian Truck Industry registered a 25 per cent growth in FY 2019 compared to FY 2018. The industry is facing new trends due to changing market dynamics. The tractor-trailer market and heavy-duty segment also started to move in a different direction. The tractor Trailer segment noted a 15 per cent degrowth due to heavy-duty customers moving to the Rigid Truck segment. Tata, Ashok Leyland, and Eicher are the market leaders in some segments.

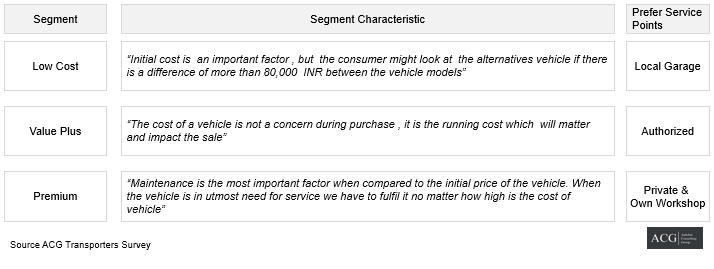

The main market can be defined as the Low, Value Plus, and the premium truck segment.

In this report, we will cover and analyze the details of the commercial vehicle market and the needs and requirements for customer satisfaction.

Commercial Vehicle Industry Landscape:

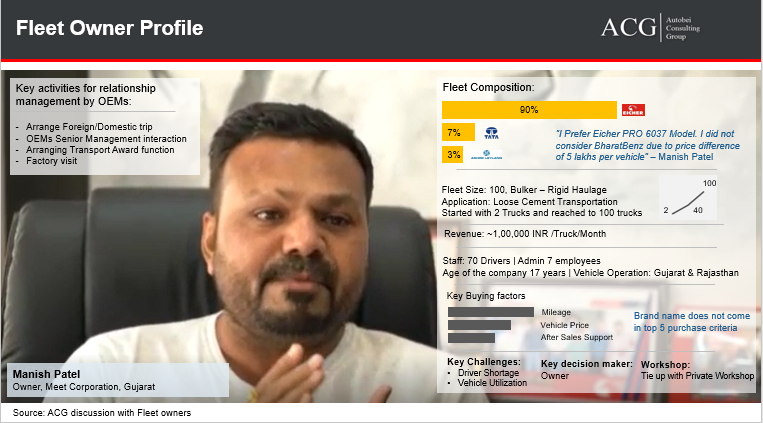

The fleet owners or transporters are the key stakeholders of the commercial vehicle industry. There are five main components for the fleet owners which will include vehicle, financing, product support, vehicle Body and other value-added services provided by the companies. By selecting the best combination of the CV package they try and invent methods to increase their profit level and make maximum utilization of their fleet capacity. A good profit level can be attained precisely through the (best suitable for application) vehicle purchase price, choosing the most appropriate truck which will suit the required application.

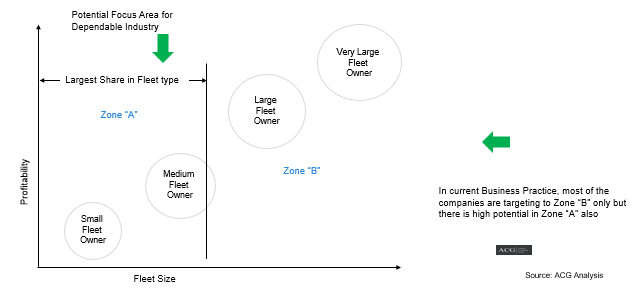

The CV customers are mainly divided based on the vehicle application, type of vehicles, and fleet size. Based on the fleet size this segment can be further divided into a single fleet owner, small fleet owner, medium fleet owner, large fleet owner and corporate or very large fleet owner. The key challenges for the transporters are improving their profit level, shortage of drivers, Loading and Unloading mechanism, after-sales, and better fleet Utilization.

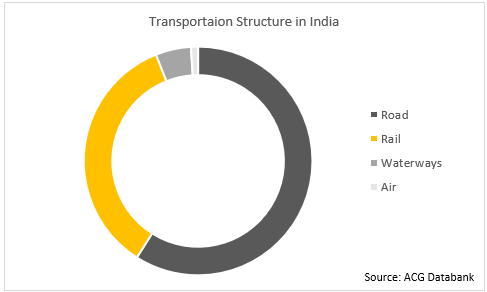

Currently, freight transport in India is mainly dominated by road transport. Transportation through road medium accounts for 59 per cent of freight movement. 35 per cent of freight demand is met by rail transport, 5 per cent of freight movement is maintained through waterways and less than 1 per cent of freight transport is by air transport.

Fleet Owner Business Model (Small, Medium, and Large)

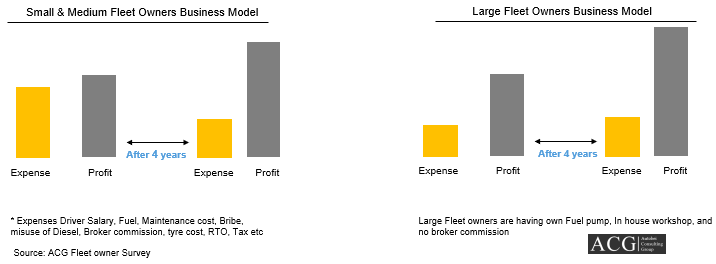

Small and Medium Fleet owner business model:

Small and medium fleet owners face many critical issues. Their profit is also less when compared to other segments. The small and medium fleets most of the revenue is used to cover the operating cost of the vehicle like paying EMI, driver salary, tax, maintenance cost, brokerage fees, and tyre replacement cost which is one of the major issues which comes under the maintenance section. The profit during the time of paying EMI is very small. For long Haul, fuel cost is around 60%. Once the loan amount is fully paid, they start to make some profit. Another way to make money is by selling the vehicle at market value after a certain period of usage.

The Small and Medium fleet owners are struggling to make a good profit because there is strong pressure on the trucking firms to provide low-cost service. To win business in those hyper-competitive markets, truck operators commonly resort to illegal tactics such as overloading and driving more hours per day than permitted under hours of service regulations. The scenario is worst in the case of the tipper which is used for coal transport purposes.

Axle load norms Impact:

After the amendment of axle load norms, Transporters are making more profit after considering the extra burden of Mileage and other impacts on vehicles like maintenance and Tyre life. Clients of Transporters Started to demand to lower the freight rates since the permissible payload increased. On the other hand, Fleet owners started to demand to Increase in freight rates. They are considering the extra maintenance cost, Tyre cost, fuel consumption, etc.

Maximize the profit:

Trucking costs are the key factors in the transportation component of total logistics cost accounting which will account for more than 65 percent of that cost. To reduce these costs a three-pronged strategy can be adopted:

- Maximum Utilization of Truck capacity

- Increasing fuel economy of trucks

- Lowering the total fixed costs

Medium-size Transporters can increase their profit margin by properly tracking the vehicle, improving product portfolio, and strictly controlling operating costs.

For example, in the Cement and Ash transportation sector, the average used truck (Considered the most suitable model) price after 5 years is around 30 to 35 per cent lower than the actual vehicle price. This 30 to 35 per cent will be the transporter’s profit after 5 years of usage.

For large Transporters, their profit is better than Small and medium fleet owners. Large fleet owners are having better profit because they have their own workshop, spare parts inventory, direct contact with consigner and they will have their diesel pump. This will make significant efforts in cost reduction. Own workshop could save 20 to 30 percent cost.

Fleet Owner Business Profile:

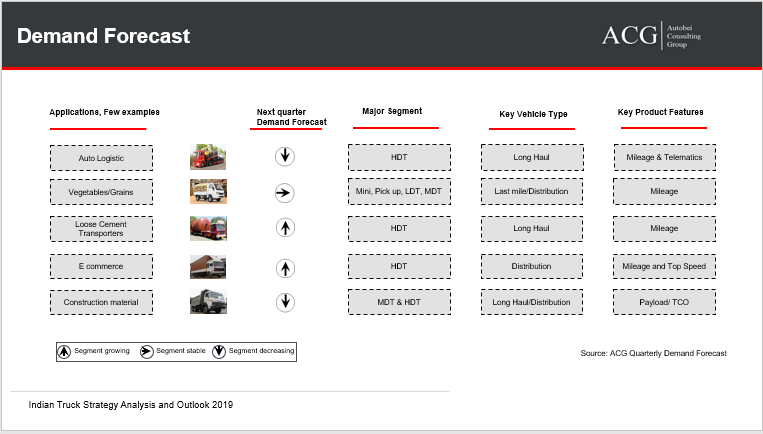

Demand Forecast:

We have noticed major changes in the market dynamics in the last 6 months. ACG does the market forecast every quarter. Some of the Application wise Truck Market Forecast are listed below:

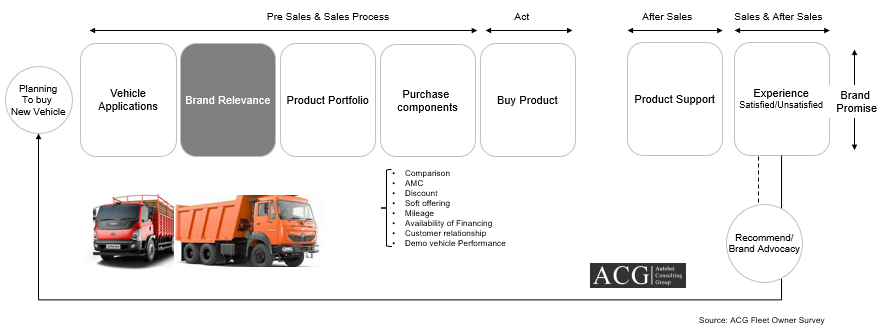

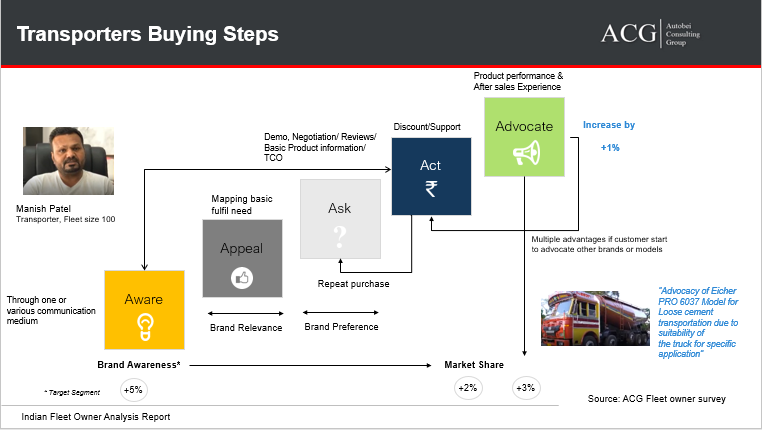

Customer complete Purchase journey:

We have spent an enormous amount of time understanding customer behaviour, reactions, preferred choice, Brand Relevance, Product selection, after-sales issues and so on. We do not do surveys but our expert’s discussion with them on the most critical issues and other business dynamics helps them understand the flaws in the system.

We found many customers who recommended the brand and product to other customers in his circle. We have identified the reasons for the recommendation.

In our initial journey, brand relevance is an important factor in converting the name of the brand into sales. We have done an exclusive study on brand relevance.

We have also researched the Indian truck market characteristics based on performance, distance, and applications in detail.

Truck Driver Issues:

The availability of drivers is another challenge for Transporters. There are two sides to the Truck driver’s issues. One of the major factors is a social and economic factor which is present not only in India but also in a developed country like Germany. Health is also another challenge for drivers depending on the driving time and resting period. Fleet owners considered a small amount like 1,000 Rs for reimbursement during on-duty health issues.

Employment in the Indian logistics industry, particularly as a truck driver, is a hard life. Truck drivers typically spend long periods away from home and family; more than 25 per cent of drivers return to their home base only after 10 days. This time gap will reduce the quality of life and this will lead to poor outcomes in both physical and psychological health. Around 50 per cent of the truck drivers face driving-related health issues. In the year 2018, approximately 70 per cent of truck drivers did not have any medical check-ups. Truck drivers are also poorly paid, earning only half as much as cab drivers. Furthermore, poor logistics practices often lead to unsafe practices such as overloading of trucks, which will make them compromise road safety both for truck drivers and those with whom they share the road.

This combination of factors— low pay (7,000 to 10,000 INR monthly), high risk and low quality of life is driving a decline in the number of truck drivers. From 900 truck drivers per 1,000 trucks in 2001, the number fell to 550 truck drivers per 1,000 trucks in 2018.

Some companies are taking the initiative and trying to support truck drivers. One of the companies started to provide hygienic food at 90 Rs to Truck drivers on the highway and the facility to park their vehicles at night.

Another non-profit organization IIFM started to train the drivers, provide Social security benefits, give them an identity, Professional benefits and so on.

Some people take advantage of this shortage of drivers to arrange for a CV driving license illegally to become a truck driver. The transporter firm does not check the authenticity of the license and also it is a difficult task to know about drivers. It is also noted that many times criminal people also follow the same practice to attain the license. Happened many times that these illegal truck drivers sold the transporter’s material which they drove and ran away with the amount.

Another challenge is when a driver wants to become a fleet owner; it is a difficult task to get finance. If they become the fleet owner, they need finance to manage operating costs. Most of the companies are offering services to fleet owners but not drivers. Automotive suppliers, OEMs, and Financial institutes should take CSR initiatives for drivers to manage operating cost. Many firms hesitate to do that since it will impact their profit range.

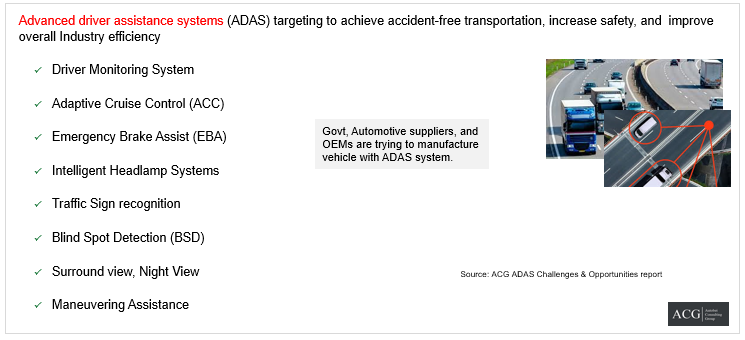

Brands should leverage such social issues to make the market better for their better future. It is easy to connect with potential buyers or users emotionally to sell the product rather than taking in celebrities to advertise the product to enhance the sale rate. ADAS also can play an important role not only for drivers but for the entire CV Industry.

Vehicle Efficiency:

There is an urgent need to introduce the Pallet system; this standard system increases the incredible efficiency of loading and unloading time. This system can reduce 70 percent time and this would be 25 percent more cost-effective.

The semi-trailer segment also helps to increase efficiency because the large and fully loaded truck transport carries more freight per kilometre driven. High loading efficiency can be achieved in two ways, first by moving towards the larger trucks segment and second by collecting small loads into large ones to fill those trucks.

This helps to prevent wastage of time and money. Logistics efficiency can also benefit farmers through a reduction in loss and wastage of products during transportation to markets. Brazil widely used Semi-Trailer for the transportation of Agricultural products.

The fully loaded trucks are dispatched in time by technologically and operationally sophisticated logistics. The logistics are the optimal state of affairs. Medium & Heavy trucks require sufficient infrastructure to enable their effective operation.

The cost of the freight movement by road is 2.61Rs/ton for one km as compared to 1.43 Rs/ton per km for rail and INR 1.09/ton per km for waterway transport. The transportation by Truck provides a lot of flexibility to transporters and the consignee.

The revised and improved measures will improve logistics and improve the overall performance of all sectors.

Efficient logistics is a cornerstone of the continuation of India’s economic development over the coming decades.

By reducing the transportation cost by 5 per cent in India, the demand will increase between 6 to 12 per cent depending on the type of products and other product characteristics. The truck logistics cost is one of the major cost factors in the entire supply chain it has to be maintained efficiently for a better profit margin.

India loses 20 to 30 per cent of agricultural production profit due to wastage in the supply chain. Reducing that wastage could both provide a boost in the income to the farmers and also lower overall prices to produce and create better access to high-quality food for Indian citizens.

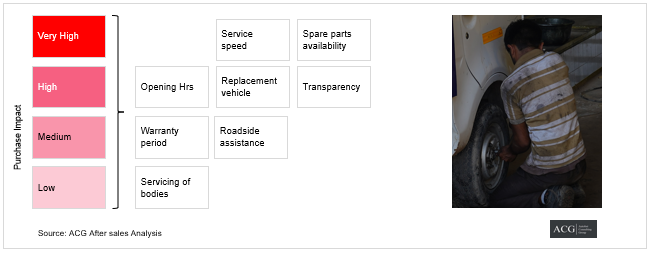

After-sales or Product support is always a very critical issue for Transporters since it is business for them. We have identified various parameters which will impact the clients on their first time and repeated purchase of products.

Many Tech companies are trying to penetrate commercial vehicle by introducing many latest technology solutions. Until and unless the companies do not understand the ecosystem, it is difficult to be successful in the market. The truck industry is dominated by small and medium-sized transporters and the profit of this segment is less. The truck industry does not have enough budgets for digitization and technology development. Another reason for the reduced success rate is the declined literacy rate of the drivers, and fleet owners, and the third reason is conventional business practice.

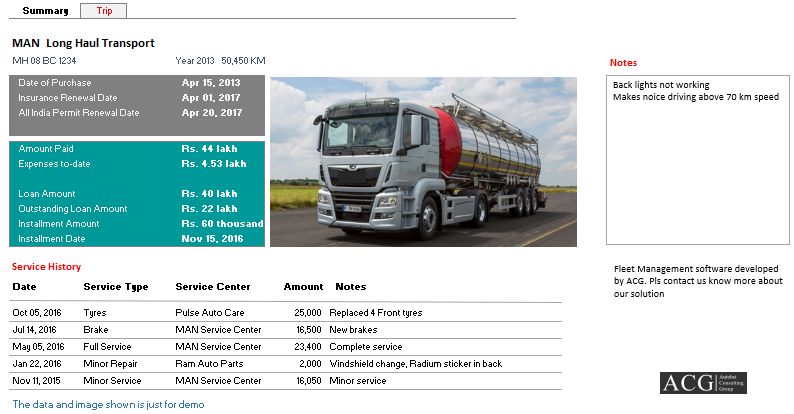

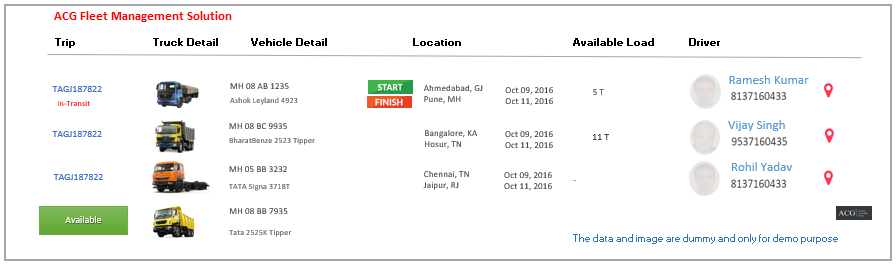

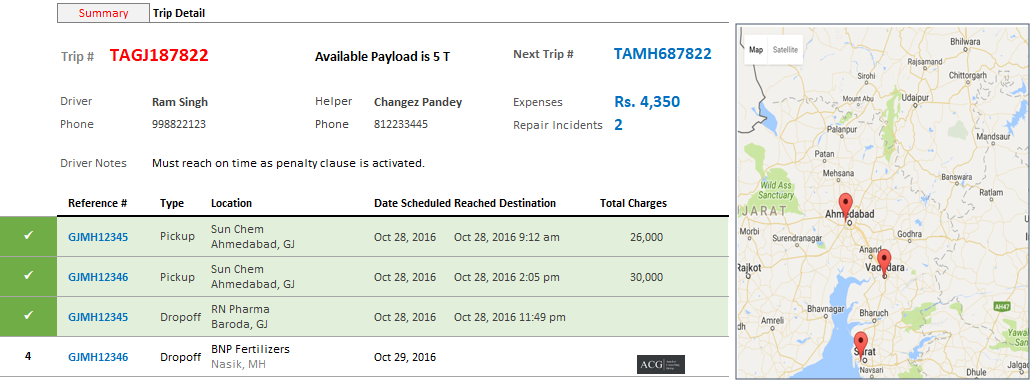

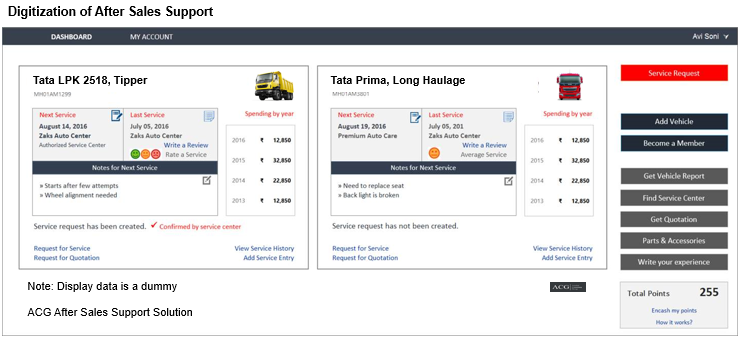

ACG developed Exclusive software for Fleet Management companies which would help all stakeholders of the Industry. It improves Transporter’s efficiency immediately after implementation. It is suitable for medium and large fleet owners.

Key Aspects of Post Sales:

To keep the post-sales cost on the lower side the manufacturers necessarily need to implement some of the effective strategies of maintenance like maintenance based on time, condition and predictive maintenance with the use of remote monitoring for the improvement of the product uptime. The companies can significantly reduce the ownership cost by lowering the costly repairs, enhancing the lifecycle of the products and an improvement in the performance of the product.

In the first part, we analyzed the Long Haul vehicle and in After Sales, we are talking Tipper as an example. The tipper customers have to necessarily total ownership cost over the vehicle’s life cycle. The cost of operation of the vehicle like the wages of drivers, fuel and other tax and toll charges contribute to the total ownership cost. This is estimated to be about two-thirds of the total cost. The balance of accounts post-sales is ten percent and nine per cent depreciation of the vehicle. The post-sale cost of ten per cent is further divided into eight per cent for repair & maintenance and two per cent for oil, tyres and vehicle cleaning. The mentioned percentages might differ as per the pattern of usage. For example, we can consider the ones whose usage of the vehicle is less intense, the post-sale cost will be around ten per cent. But on the other hand, the cost might be around twelve per cent if the vehicle is used in conditions that are quite challenging. The post-sale cost can further be divided into labour and parts. Only labour averages to about forty per cent of the total post if the service, as well as the maintenance, is done at OEM garages. The remaining sixty percent is for the spare but those are consumed directly at the time of maintenance and repair.

Repair and maintenance are two different activities that are being performed at the service centres of the OEMs. The maintenance of the vehicles includes inspection along with the wear and tear. The inspection so carried out are recurring jobs that have to be necessarily carried out at regular intervals of time depending on the kilometres run by the vehicle. Wear and tear refer to the small damages occurring normally as the ageing process of the vehicle. Wearing out of the tyres or the replacement of the oil filters or the air filters are examples of wear and tear. This is a gradual process and hence possible to go for scheduled maintenance as per the requirements. For general maintenance, downtime cannot be avoided. Therefore, the ultimate objective of the Tipper customers should be to keep the related costs on the lower side as much as possible.

Process of Breakdown:

Repair and diagnosis as a result of any breakdown or an accident happen unexpectedly and this is the reason why it is so important to minimize the downtime. This is even more important because a huge number of manufacturing companies necessarily deliver the items to the customers just in time. The delays in shipping seriously impact the parts supply of the downstream supply chain activities. The manufacturers in this regard provide 24*7 backup as an emergency but they should also provide the first time appropriate diagnosis by keeping handy skilled and trained manpower along with the possession of the required diagnostic tools. Once the diagnosis has been made at the time of attending the breakdown process, the less complicated breakdowns should be dealt with instantaneously on the spot and in the more complicated cases the vehicle should be towed to the nearest authorized service centres where the repairing should be either immediate or within 24 hours depending on the hours of business, the severity of the breakdown and at what time it has occurred.

Requirements Of Customers

For the minimization of the total ownership cost, low-priced services are essential and the same goes for the spare parts as well. However, the needs of the customer regarding uptime as well as the total cost of ownership do not have the same importance across all the segments of customers. For the owner-operators, the requirement for high service availability is of immense importance if the vehicle happens to be a vital tool for the conduction of business. The requirement for high-quality post-sales for the owner-operators is just as important as compared to the other CV customers. Despite the strong need for lowering the total ownership cost, there are only a few options available for the reduction of these costs.

The operators of large fleets usually pay the most attention to service availability as well as quality. They get on terms with the manufacturers for some of the special deals at the time of purchasing the vehicle, where they ask the manufacturers for fixed costs based on per ton-kilometre and service levels. The operators of large fleets and municipalities generally have a very critical fleet size for the determination of whether setting up a proprietary service workshop would be an economically better option or offering additional cost reduction potential would be better.

Different Types of Service Providers:

- Customer workshop available in the house

- Private parties owned workshops

- OEM’s authorized garages

- Workshops of OEM.

In general, the customer workshops available in-house are equipped for providing only very simple services like the treatment of wear and tear, minor inspections and very simple repairs. The private garages usually deal with almost all types of OEM vehicles and are necessarily in possession of all sorts of sophisticated tools as well as equipment and can offer even breakdown services to the customers. The Garages that are authorized by OEMs generally have all the types of required tools and equipment. The manpower of OEMs is adequately trained and vastly experienced to provide all sorts of services that then customers require. But still, there are several customers who prefer only the OEM workshops where services are quick and prompt along with the availability of a required set of tools as well as equipment and also with backup spare parts. Thus, almost all sorts of service and maintenance-related decisions are taken rapidly which in turn plays a vital role in the reduction of downtime to a great extent.

To sum the whole thing up, the post-sales costs are certainly one of the most critical elements which get the attention of the Tipper customers. Thus, at this point, they should be following

the two objectives of uptime maximization of the vehicle and total cost of ownership minimization post-sales. By doing the same, depending on the customer segment, the Tipper customers can necessarily select between the authorized, independent, and in-house customer workshops, which are varying in their scope as well as the capabilities of the service. Moreover, a few of the cases mentioned above can be certainly taken care of necessarily at the spot of breakdown itself. In many cases, the vehicle might require to be towed to the authorized service centers that are nearby.

Development of the OEM Owned And Authorised Service Outlets:

The service outlets owned by the OEM are on the rise and this rise is very likely to go on for two main reasons.

- Firstly, the OEMs many times find it very difficult to find the appropriate independent investors in the areas that are less populated initially.

- Secondly, some OEMs have intentionally chosen to follow a network strategy that is owned by the OEM to be much more responsive to the market conditions that are volatile.

During the warranty period, almost all of the fleet owners necessarily make use of OEM service outlets, and post-warranty period, the owners who have a fleet strength of about 80 to 100 vehicles prefer to have their setup for service. But on the other hand, the small fleet owners maintain a tie-up with local service centres for all types of minor routine work and when they face some major problems, they take help from the OEM service centres.

For the fleet owners who have achieved a certain fleet size, for them, it might be a good option to set up their in-house service workshop. Now, when they have their workshop, the fleets necessarily have much greater flexibility at the time of scheduled maintenance and often they can achieve lower costs owing to the fact of the lower expenses for marketing and overheads. However, it is to be kept in mind that the capabilities of these in-house workshops are generally limited, since the main focus is only on the simple maintenance services. But in case the more complex maintenance services and repair, the work is to be necessarily forwarded to external service centers.

Distribution of Spare Parts:

The spare parts distribution network is much more complex as compared to the service network for the four main reasons that are listed below.

- In the case of the service network, it is only the CV operators who are only indirect customers, whereas, for the network of spares, it is the OEM-owned or authorized service outlets, independent service providers, as well as the in-house workshops of the customers, are the direct customers.

- Coming to the supply side, apart from the OEM, the OES and the parts of matching quality producers also exist. The OES not only sell the parts to the OEM but also, sell on the aftermarket at the same time.

- The parts of the matching quality producers are usually from low-cost countries, like China, which provide similar copies of the OES parts at a very competitive price.

- Finally coming to the side of distribution, both the OES and parts of matching quality producers have the scope of either selling directly to their customers or selling through independent parts wholesalers.

Share of The OEM Parts:

Despite the presence of matching parts manufacturers, the share of OEM parts is on the rise because in the OEM’s organization, the OEMs necessarily benefit from the fact that suppliers are also the consumers. The service outlets owned and authorized by the OEMs directly consume the spare parts which they need for providing the required service to CV customers. In particular, the service outlets that are not only owned by the OEMs but also are authorized by them necessarily have a very high degree of loyalty to the OEMs and the major portions of the spare parts are also received through the OEM’s organization. In addition to this, the OEMs get a lot of benefits from the coverage of the total value chain. About one-third of the total CV customers purchase the maintenance as well as the repair packages in addition to the vehicle itself. Now, in these cases, the OEM takes the risk of future maintenance as well as repair costs and thus the vehicles are serviced within the network OEMs along with receiving all of the required spare parts through the OEM’s organization.

To increase the reach of almost all of the CV manufacturers, it appoints an exclusive spare parts outlet or the distributor. These outlets or the distributors necessarily make sure that the spare parts are available at the retailer’s shop as well. The spare parts outlets owned by the OEM are expected to rise modestly, but given their low significance in the overall share of outlets, this rise will be quite marginal. In recent times, though the number of outlets has gone down, it is expected to grow again in line with the overall market thereby an increasing trend would be followed in the case of the parts outlets.

Source Of Spare Parts of Authorised Outlets:

Now, if we consider the supply of parts by respective service providers, the service outlets owned by the OEMs receive a hundred per cent of their spare parts through the OEM organization as they are an integral part of the same. However, on the other hand, the authorized service outlets do not have any kind of obligation to source their parts through the OEM. Instead, the service outlets that are authorized have the freedom of choosing where to source their supply of spare parts.

The spare parts outlets that are authorized can enjoy a lot of advantages at the time of sourcing the parts from the OEM. For example, we can consider the OEM’s organization. First of all, the OEM provides great support in the adequate stocking of the parts. As the authorized spare parts outlets maintain a wide range of spare parts in stock, they require to have detailed knowledge along with historical data for the determination of the optimal levels of stock for each of the parts individually. Secondly, the OEM covers the risk in a case when the levels of stock are not true. This happens either when the stock levels are too high which has led to a very high capital employed or in a case where the stock levels are too low which means that there is a requirement of an emergency shipment by the OEM. Thirdly, the authorized outlets take advantage of a high-performing, proven, trusted as well as a reliable network of logistics and IT systems. Fourth, the authorized outlets are one-stop shopping and a common part numbering system greatly reduces the complexity of communication and IT systems. Ultimately, the customized financial conditions also help in providing an incentive for sourcing the parts from the OEM, and this in turn finally results in the lowering of the costs of sourcing.

ACG developed exclusive software for the Automotive Industry:

Key Highlights of the report:

- Indian CV and Truck Market size in Volume (Volume) & Value (in USD)

- Application Short, Medium and long-term Demand Forecast

- Impact of New norms on the Commercial Vehicle market like pricing, demand and after-sales support

- State wise Market size, Key players, and Forecast

- Pricing Strategy and discount trend

- After Sales Service Analysis

- Key Market Drivers and Dynamics

- Key Model – Specs, Features, and Price

- Application-wise Demand Analysis

- OEMs-wise Product Strategy

- Indian Transportation Industry

- Fleet Owners Survey

- Fleet Owner Business Model

- Freight rate analysis

- Fleet owner pattern trend

- Key factors for Fleet owners

- Market forecast

- Technology Role Indian CV Industry

- Customer Buying Journey

- Competitor Analysis

- Product Strategy, Portfolio, and Portfolio

- Segment wise Application Product, Market share, and OEM wise Volume

- Segment Analysis: Small commercial Vehicle, Light Commercial Vehicle, Medium Commercial Vehicle, and Heavy Commercial Vehicle

- Sub-segment Analysis: Mini Truck, Pick up Truck, LDT, MDT, HDT, Tractor Trailer, Tipper and Special Application

- Segment shift Trend and Forecast