There is high hopes and hype in the Indian Commercial Vehicle Industry for the upcoming time.

The Indian Commercial Vehicle Industry will witness overall positive changes in the year 2018. MHCV segment has shown signs of recovery for testing situations since July 2017. The implementation of GST and restriction of overloading has tempted the Truck Industry to make a shift towards higher tonnage and technical advance products. With the implementation of new strategies and tax policies, more trucks are required to carry the similar load which has created the demand for the new vehicle for transport services. OEMs have already started to do the optimizing of their warehouses.

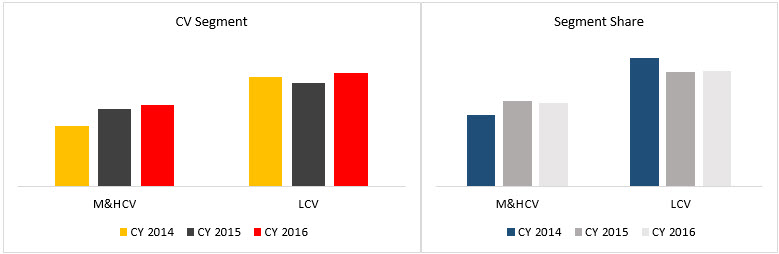

The 41T GVW truck which consists of 16 tires is the new category introduced in the rigid haulage segment. All other segments like a small commercial vehicle, light commercial vehicle and the medium heavy commercial vehicle will also see some changes due changing in market dynamics in the near future.

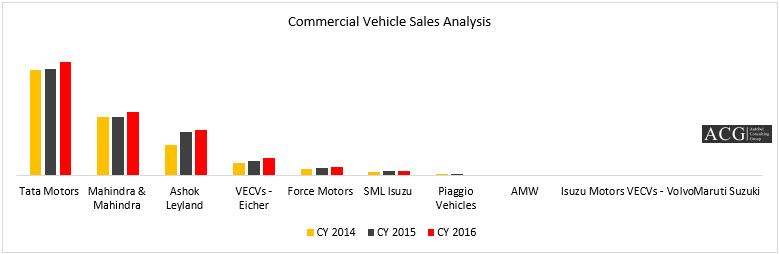

For a stable growth and steadiness in the market OEM presence and portfolio of the product play an important role in their growth. Other parameters and tactics which will have an impact are the network expansion and value proposition of the product which will have a medium and long-term impact on the market demand. E-commerce segment will also have a positive impact on truck growth with some changes in loading span and payload capacity.

There is a downward slide in the bus segment after the implementation of GST. Bus code and GST have had a negative impact on the bus industry, especially on an intercity application and higher tonnage bus segment. After the implementation of GST the local bus body price has been increased.

There is still ambiguity on the used vehicle tax structure under GST tax policy.

There is an expectation for an increase in vehicle price due to increase in commodity price and oil price. There is an optimization in the logistics sector and OEM warehouses, the number of depots has been drastically reduced and hub and Spoke model is more relevant after the GST implementation. This trend will make way for the need for more improvised and efficient trucks, better TCO, more productive trucks, need for the modernization of fleet.

Report highlights:

- How will the new segment 41T impact the market and how will the market shift toward this segment?

- How would tractor trailer segment impact the market?

- How will CV Industry have an impact on the rural market?

- How will the multi-axle truck impact and fulfill the market demands?

- What will be the Impact of GST on vehicle Price and discount trend?

- Which segment in the vehicle will attract more customers to the vehicle industry for next 3 years?

- What would be the impact of the construction industry, mining industry, steel industry, cement industry, E-Commerce, day to day load and industry analysis on the truck Industry?

- What are the methods for improvising the strategies in market competitiveness?

- What will be the future strategies of OEMs like Tata Motors, Ashok Leyland, Eicher, BharatBenz, MAN, AMW, in the field of bus application wise?

- How will the future trend along with STU sales Analysis?

- What will be the margin of impact on OEMs?

- What will be the challenges faced by the large fleet owners in the market?

- What will be the impact of GST on used truck sales?