The Indian Truck market is one of the most attractive markets that has been a focal point of the development of many Foreign truck manufacturers. European players are busy occupying their position & space within the market, and various Asian including Chinese manufacturers are evaluating the potential of this segment.

The rigid Haulage segment is the biggest truck segment, Tipper is the normally profitable segment and Tractor is a growing segment in India. The key driver of the segment is E-Commerce growth, New Construction, Overall positive sentiments in the Macro Economy, road infrastructure and long-distance transportation of commodities will experience positive growth.

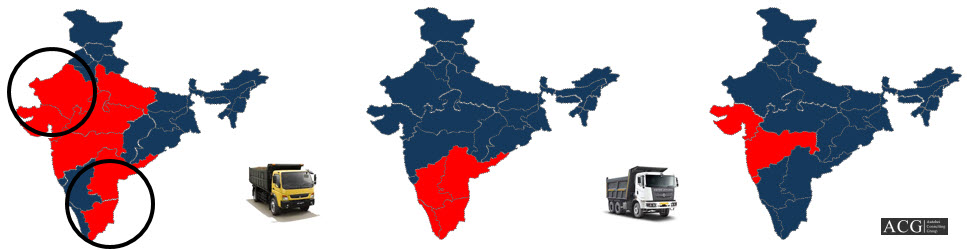

In general, trucks can be divided into Premium, Medium Budget, High Budget, and Low-Cost segments, considering the key role of Customer buying trends, OEM’s product quality, and spare parts manufacturers. Every Zone and state has different market dynamics which needs to be understood and create a strategy accordingly.

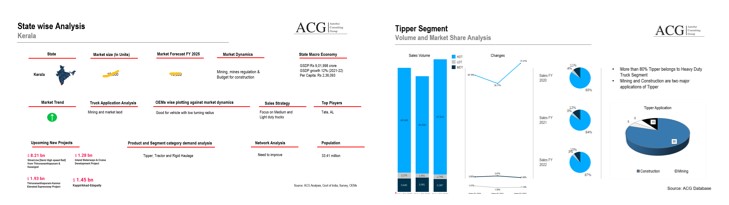

To succeed here, one must understand the state-wise dynamics since every state is diverse in terms of Customer Behavior, Nature, Type of Business, Language, Financing, Type of Industry, State Policies, Tax etc. The complexity could be compared to China.

Report Highlights:

– GVW wise: Mini, Pickup, LDT, MDT, and HDT

– Type Wise: Rigid Haulage, Tipper and Tractor

Category: Small Truck, LDT, MDT & HDT

- State-wise Volume in units and in terms of value

- States covered – MP, Chattisgarh, Gujarat, Maharastra, Rajasthan, Karnataka, Kerela, Tamilnadu, Andhra Pradesh, Goa, Delhi, Haryana, Uttar Pradesh, Uttarakhand, Himachal Pradesh, J&K, Assam, Punjab, West Bengal, Bihar, Jharkhand, and Odisha.

- OEMs Covered – Tata Motors, Ashok Leyland, Mahindra, Force, Maruti Suzuki, Eicher, Volvo, Scania, and BharatBenz.

- Truck Segment Analysis – Tractor Trailer, Tipper, and Rigid Haulage

- Key Truck Models, Price, and technical specs

- Key Growth Drivers in each state

- State-level Sales Outlook

- Region and state-wise Trends and forecast

- OEMs Presence, Volume, Market share forecast

- State-wise mapping of market dynamics, Product & Brand Suitability

- Truck Application Analysis

- Fleet Owners Truck Customer Behavior Analysis – Small, medium, Large truck operators, and Municipal

- Truck Type Sales Analysis

- Other Industry Analyses like Construction, Logistic, E-commerce, Mining, Engineering, Manufacturing, Chemical, and others

- Dealer Network analysis

- Technical Analysis of Trucks

- Case study of MAN, BharatBenz, Tata Prima, Volvo, and Scania