An analysis of the bus market is carried out in the following report by comparing the various criteria of 2015 with that of 2014.

Bus Market Overview: Brand wise

The above graph shows the sales of individual brands in the bus market share and its change from 2014 to 2015. Tata Motors has a pleasant increase in its sales by almost 8%. Force Motors has also seen a flourishing figure as it portrays the increase in sales by more than 16% from 2014 to 2015. Ashok Leyland, on the other hand, saw a stunning 45%increase while Eicher also witnessed an escalation in sales by more than 20% over the same time.

Market Share:

The sales seen in the previous trend comparing each company can be linearly translated into its market share figures. As expected, Tata Motors stand at the top bagging nearly 34% of the overall industry. Force motors have not seen a change in the year and stand with a constant 23% share. Ashok Leyland has displayed some amazing escalation to 20% of the industry as its share. Eicher and SML Isuzu have shown similar characteristics and they own a small percentage of the market share. Mahindra, with a constant 4% market share over the years has also been a significant player in this industry.

M&HCV Bus:

The bus industry is divided into various differing segments. The M and HCV bus segment have four major players, namely Tata Motors, VECVs-Eicher, SML Isuzu and Mahindra & Mahindra. Sales of Tata Motors in this segment shot through the roof with sales increasing by more than 45% from 2014 to 2015. Eicher has also seen a small rise in sales over the same period. SML Isuzu has seen a small increase in sales over the same time. Mahindra and Mahindra, on the other hand, have seen less than 5000 units sold over the year.

M&HCV Market Share:

The sales curves can also be translated into the market share. The key players with have a hand on almost all the industry are Ashok Leyland, Tata Motors, VECVs-Eicher, SML Isuzu and Mahindra &Mahindra. Ashok Leyland's market rose by 2% from 2014 to the successive year to yield a 41%market share. On the other hand, Tata Motors dipped by a 5% to yield a 37%market share. The other three companies also contribute minor shares to the industry.

LCV Bus Segment:

The LCV segment is analysed next and each brand is plotted separately to give an overall view of the segment. Force Motors saw a 16% increase in sales from 2014 to 2015. Over the same time, Tata Motors saw a 5% increase in their sales. VECV Eicher saw an increase in its sales by more than 20% while SML Isuzu saw a 5% increase. Perhaps the only company that saw a dip in their sales was that of Mahindra &Mahindra, which portrayed a 7% decline in sales. Ashok Leyland is barely visible in this segment.

LCV Bus Market Share:

The LCV segment's share can be directly linked to its sales figures when it is seen that Force Motors has 43% of the market in 2015 while Tata Motors are the runner ups with a major 32%. VECVs-Eicher, SML Isuzu, and Mahindra &Mahindra on the other hand, have contributed minor shares to the overall industry.

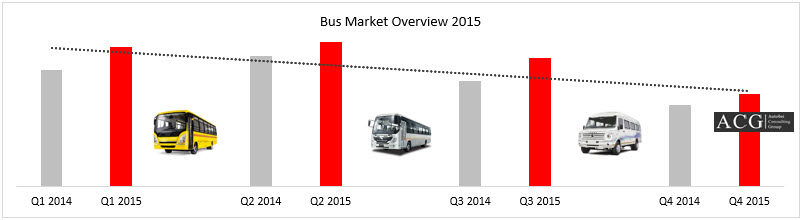

Quarter wise Analysis:

The next section of the report focusses on a quarter wise analysis which displays a comprehensive analysis of the given sector by comparing the sales in the year 2014 and 2015. Quarter 1 saw a minor 10% increase in sales over the corresponding years. The second quarter of the corresponding years shows a stagnant sales figure. Quarters 3 and 4 have seen the minor increase in sales over the stipulated duration of time.

Mahindra Sales:

The sales of Mahindra have been an upward rising curve ever since the first quarter. The first graph compares the quarter sales of the quarters corresponding to the years 2014 and 2015. Quarters 1, 3 and 4 saw escalations in the sales of this company, but however quarter 2 showed a skyrocketing sales figure showing almost a 50% increase in sales over the time.

The adjacent graph compares the market share and it can be seen that similar figures as the sales graph are translated on to this graph also. However, though there has been an increase in sales with each quarter of the corresponding year when comparing the first quarter of 2014 and the last quarter of 2015, there seems to be a staggering decline in both market share linear to its sales figures also.

SML Isuzu:

The quarter-wise analysis of the years 2014 and 2015 of the brand, SML Isuzu was done and the following graphs were plotted. Quarter 1 saw a 10% increase in the sales of this company from 2014 to 2015. This also corresponds to a 10%increase in market share. On the other hand, the second quarter saw a pretty constant sales as well as market share figure from 2014 and 2015. However, by the time quarter, 2 struck, the sales and market share plummeted down by a huge amount. This decrease was further more pronounced in the sales and market share of quarter 4 when compared between 2014 and 2015. The market share as well as the sales figures took a big hit when the first quarter of 2014 and the fourth quarter of 2015 are analysed.

Tata Motors:

Tata Motors is one of the pioneers of this industry. The above graphs show a quarter wise analysis of the years 2014 and 2015 in terms of sales and market share. Quarter 1 saw a 10%increase in both sales as well as market share over the years 2014 and 2015. By Quarter 2 however, the sales and market share had decreased. Quarter 2 saw almost constant figures of both sales as well as market share. Quarter 3, in contrast, has shown a 10% increase in sales as well as its market share, but by the time Quarter 4 hit, there was however a staggering decrease. However, when the first quarter of 2014 and the fourth quarter of 2015 are compared, there is only a very slight decrease, which applies to both sales as well as market share.

VECV – Eicher

Though VECVs-Eicher has seen a small number of sales units produced, corresponding to less than 2000 units produced and market share not exceeding 12%, it still occupies a significant share in the industry. Quarters 1 and 2 have shown flourishing figures of ascent in both sales and market share. The transition from quarter 1 and 2 has also been extraordinarily skyrocketing. Quarter 3 is characterized by a minor decrease in both sales and market share. The transition from Quarter 3 to 4 has seen a less than pleasant decrease in both sales and market share, however, in quarter 4, sales and market share hiked up, almost lining up to the same sales and market share as the first quarter of 2014.

Ashok Leyland Sales:

The above two graphs show a comprehensive quarter wise analysis of sales and market share of the years 2014 and 2015. The sales and market share figures are translated linearly on to each other and hence, the same analysis is applicable to both these characteristics. Ashok Leyland is one of the key runners of this industry and hence it becomes highly significant to obtain a well-rounded and full-fledged analysis of the same. All four quarters see a 10% increase in both sales and market share. Particularly, quarter 3 showed a significant amount of increase in sales which linearly maps into market share too. From a mere 3000 units sold in 2014 to almost 6000 units sold in 2015, the sales figures have doubled itself and market shares have reached exorbitant amounts corresponding to the same.

Force Motors:

Force Motors also occupies a significant place in the industry in terms of both sales as well as market share. It can be observed from the graph that sales have risen by at least 10% over quarters 1, 3 and 4 while the figures have been relatively constant over the year in quarter 2.

In terms of market share, there has definitely been a significant increase in the fourth quarter of 2015 waned away. They captured nearly 50% of the industry in that quarter. Similar to the sales analysis, quarters 1, 3 and 4 showed slight escalation whereas Quarter 2 showed constant figures.

LCV Bus Sales:

Mahindra Bus Sales:

Quarter 1 of Mahindra Bus saw a dip corresponding to 5%in both sales and market share from over the duration from 2014 to 2015. Quarter 2 saw higher values and constant behaviour of sales and market share over the same time, when sales hit the 1000 units mark and market share soared to 7%. Quarter 3 showed slight increases in both the variants, while quarter 4 plagued with a decrease in sales to less than 500 units and market share to an insignificant 3%.

SML Isuzu Sales:

The two graphs shown above give a quarter wise analysis of the sales of SML Isuzu over the time from 2014 to 2015. Overall, there has been a deadly dip in sales from more than 600 units sold in the beginning of 2014 to less than 400 units at the end of 2015. In terms of market share, there has been a plummet from 6% to 4%. Quarter 1 had seen a spectacular increase by almost 40% in both sales as well as market share. Quarter 2 showed the highest sales and market share seen in the year, corresponding to 1200units sold and 10% market share. Quarter 3 saw a minor dip in both variants over the same time. Quarter 4, however, showed a staggering decrease.

Tata Motors Sales:

Tata Motors rule this industry and this is clearly seen in both sales and market share. The above-shown graphs compare the corresponding quarters of 2014 and 2015 based on sales and market share. Quarter 1 saw a constant value, this value rose to quarter 2 which saw escalating figures which when compared to 2015 saw a slight decrease in sales and market share. Quarter 3 sales and market share remained constant, while quarter 4 showed a significant increase in both aspects. Overall, sales have dropped by almost 50% over the year, and most of this can be attributed to the transition between Quarters 3 and 4. It has however managed to keep market share constant during this time.

Ashok Leyland Sales:

Ashok Leyland captures a minimal space in sales as well as market share. The highest sales were recorded in the second quarter of 2015 when sales shot up to about 250 units. This comes as a surprise because of just the previous year, the company displayed a sales figure of 50 units in the first quarter of 2014. However, this figure shot down to less than 50 units sold by the last quarter of 2015.

Similarly, its highest market share was in the second quarter of 2015, owing to almost 2% of the industry which sadly plummeted down to less than O.5% as the year came to an end with the fourth quarter of 2015.

VECV-Eicher:

The above graph shows the analysis of the market share quarter wise in 2014 and 2015. Quarter 1 saw a slight increase which linearly rose to quarter 2 which displayed yet another linear increase in market share. Quarter 2 saw the best market share for the company. However, quarter 3 saw a decline in market share which moved to a homeostasis nature in quarter 4's analysis.

The above graph shows a comprehensive analysis of sales quarter wise over 2014 and 2015. Quarter 1 saw a pleasant increase in sales by almost 50%. Quarter 2 being one of highest sales also saw a 50% increase in sales over the same time. Quarters 3 and 4 showed homeostatic behaviours however by quarter 4 the sales had reduced to an insignificant amount.